Calculator Payroll

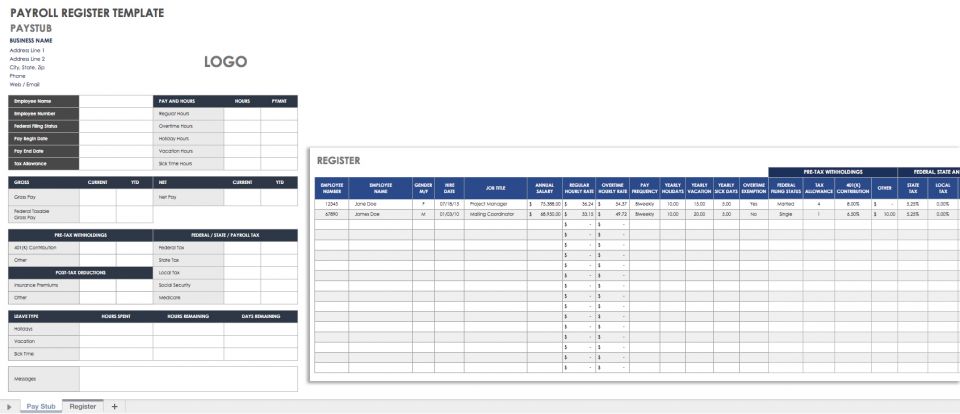

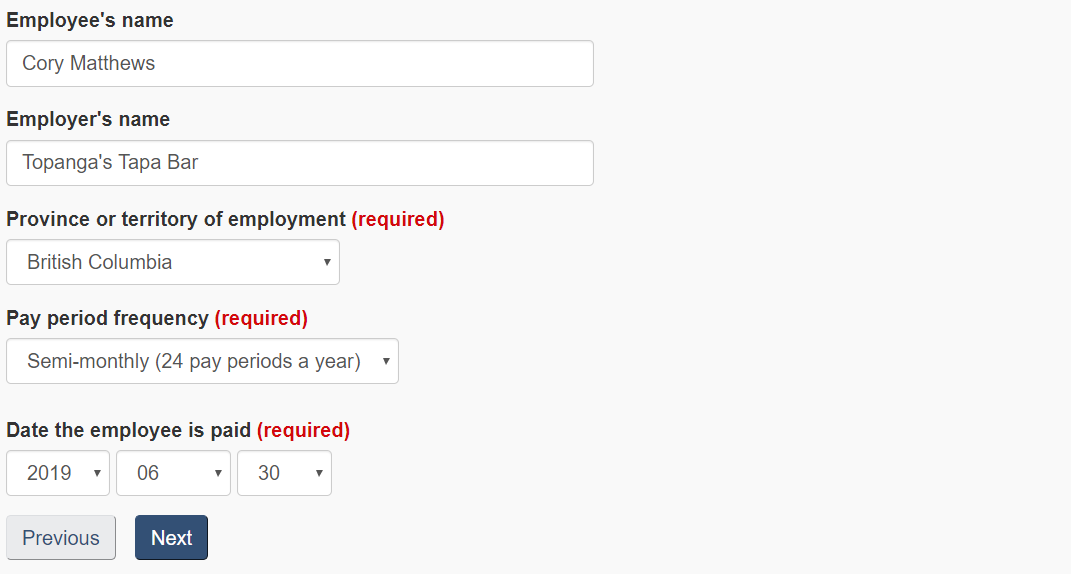

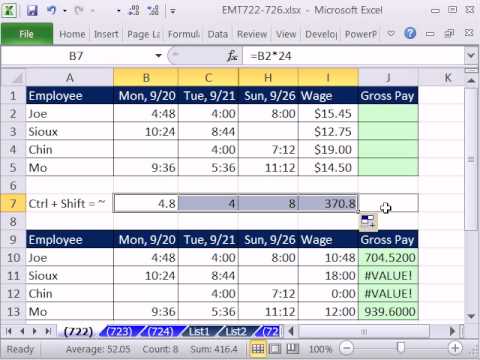

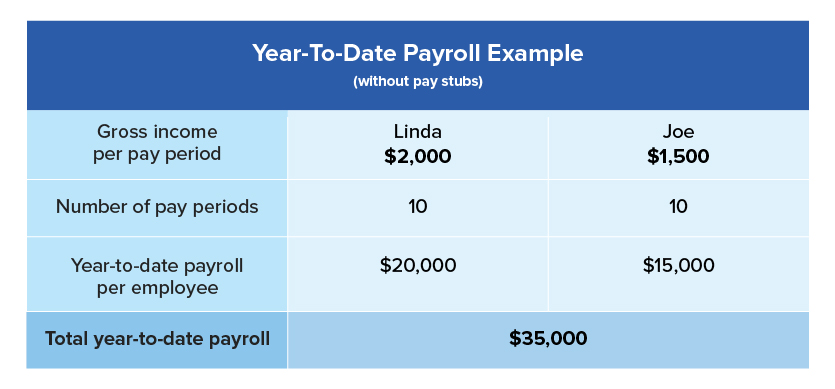

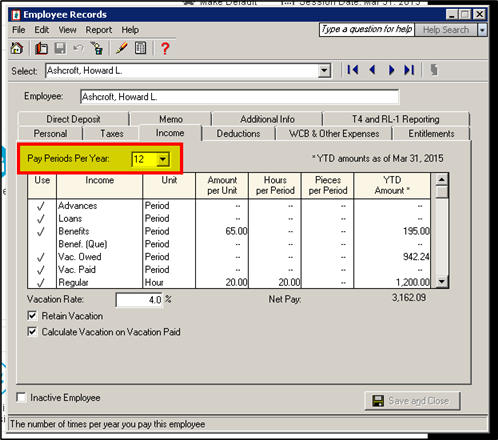

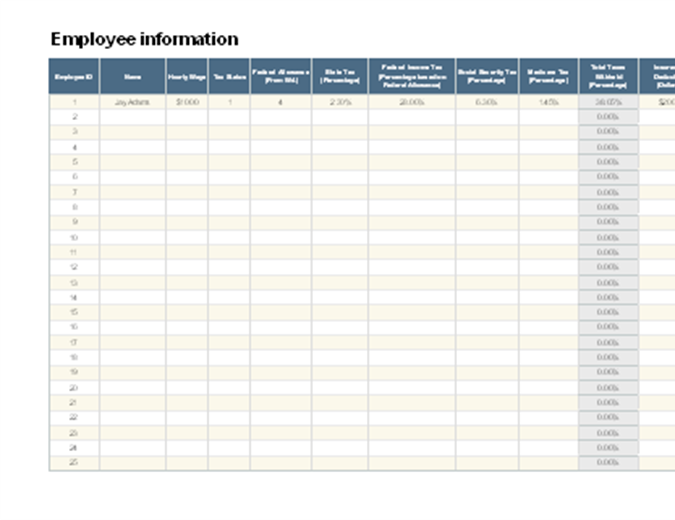

An employee who makes a gross annual income of 48000 has a semi monthly pay of 2000 or 4800024 2000.

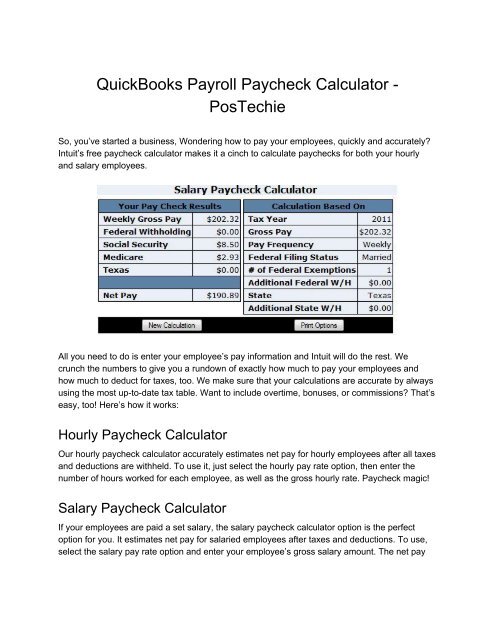

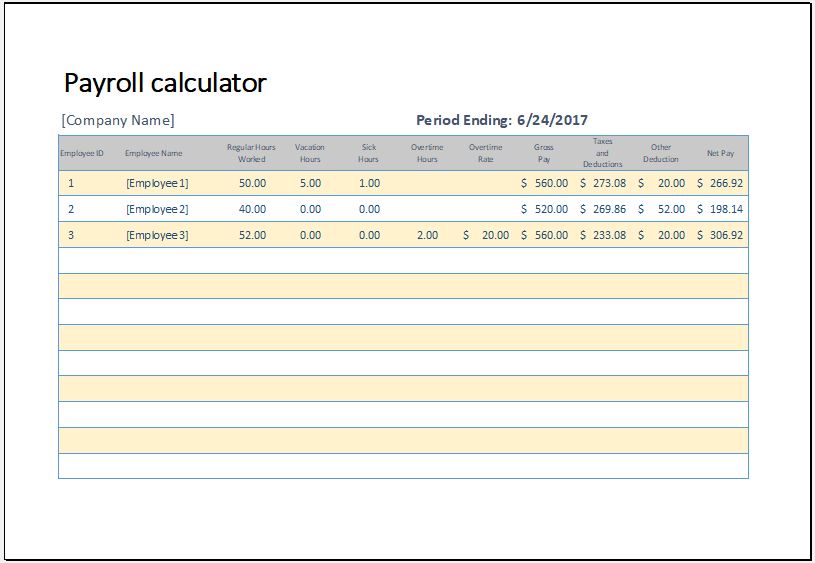

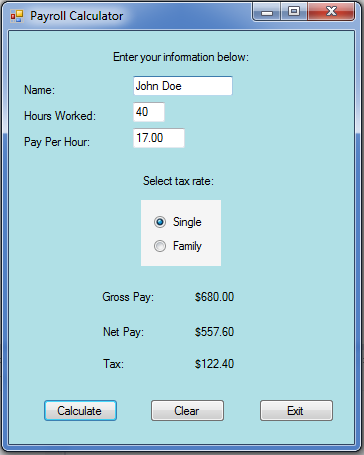

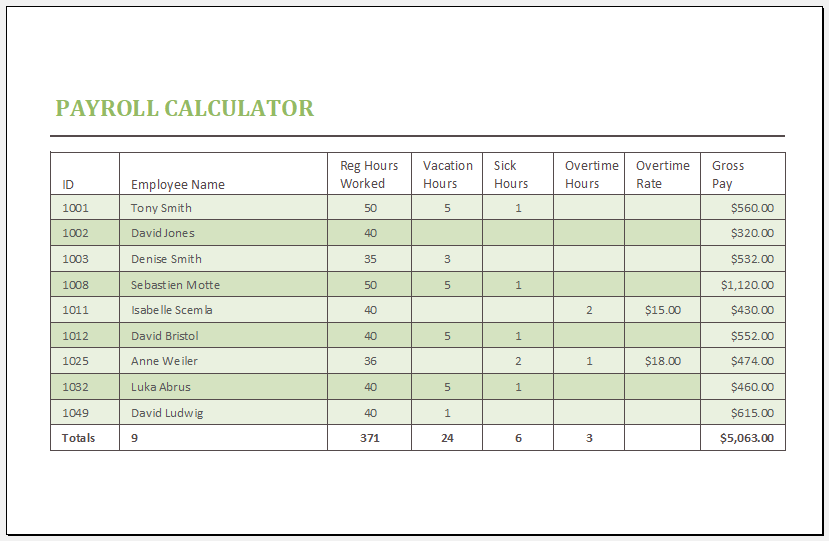

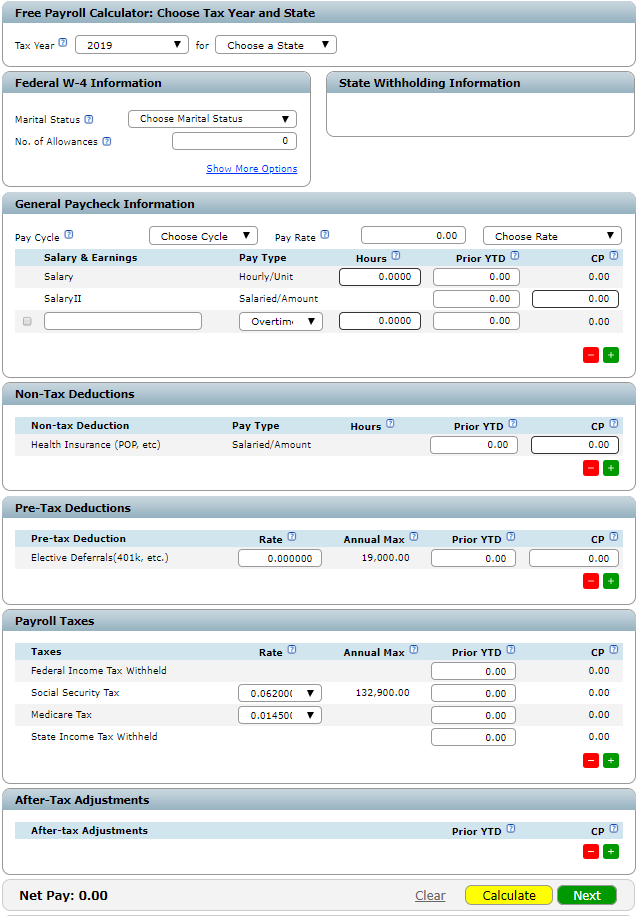

Calculator payroll. Total earning salary. To calculate the gross amount of a salaried employees semi monthly paycheck divide her annual salary by 24. Canadian corporate tax rates for active business income. 2020 includes all rate changes announced up to june 1 2020.

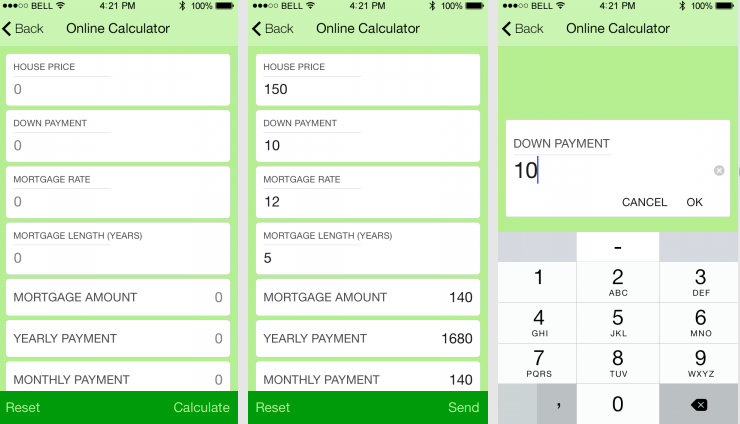

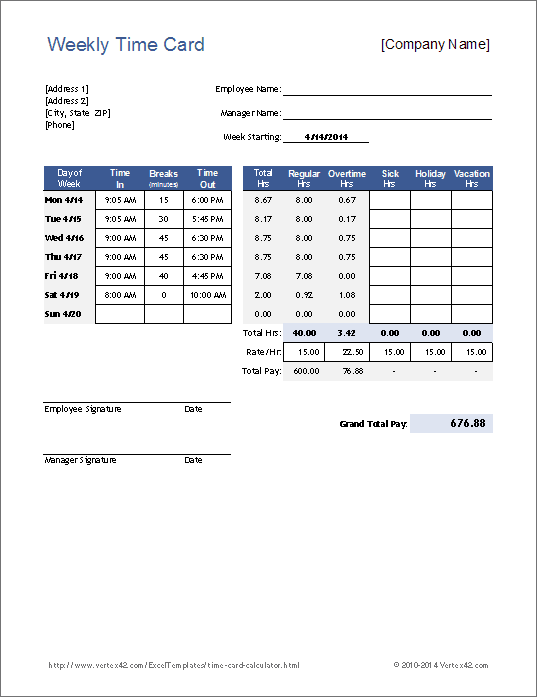

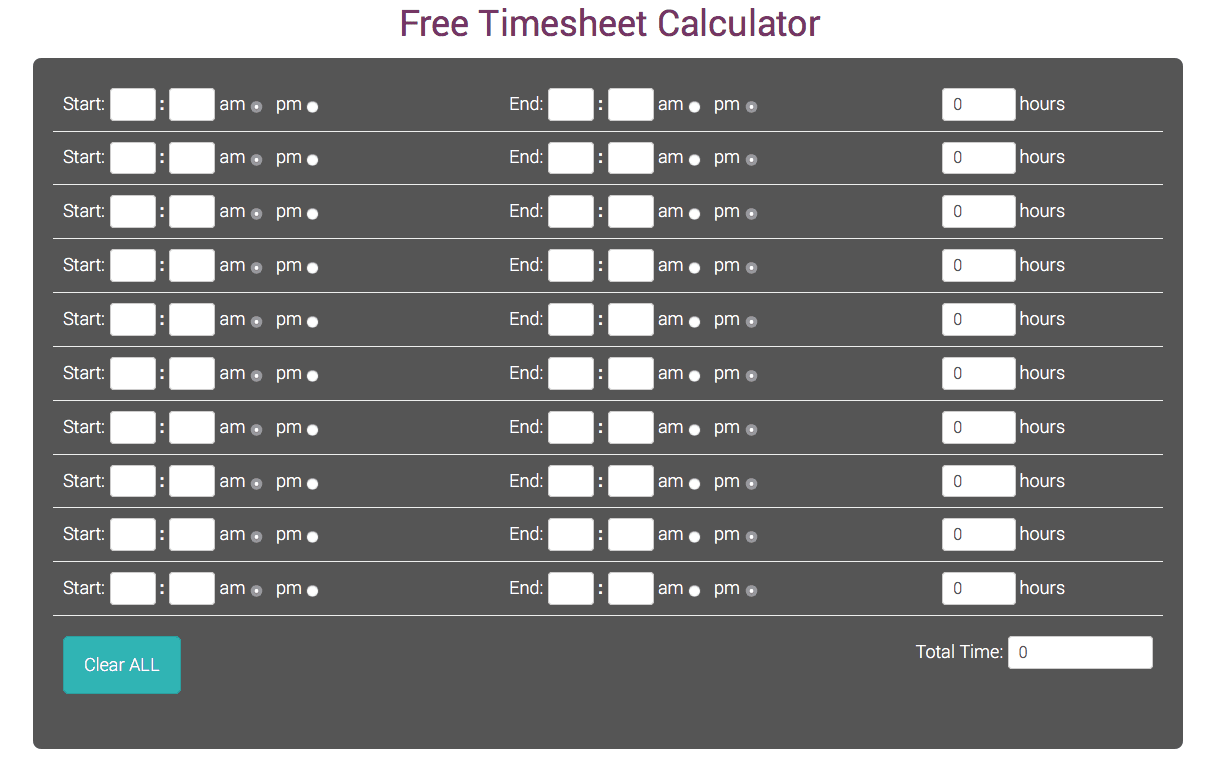

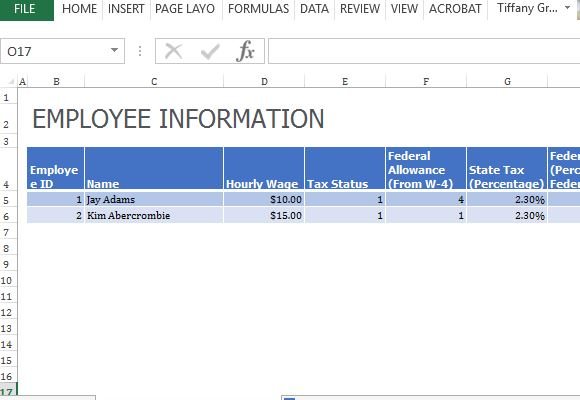

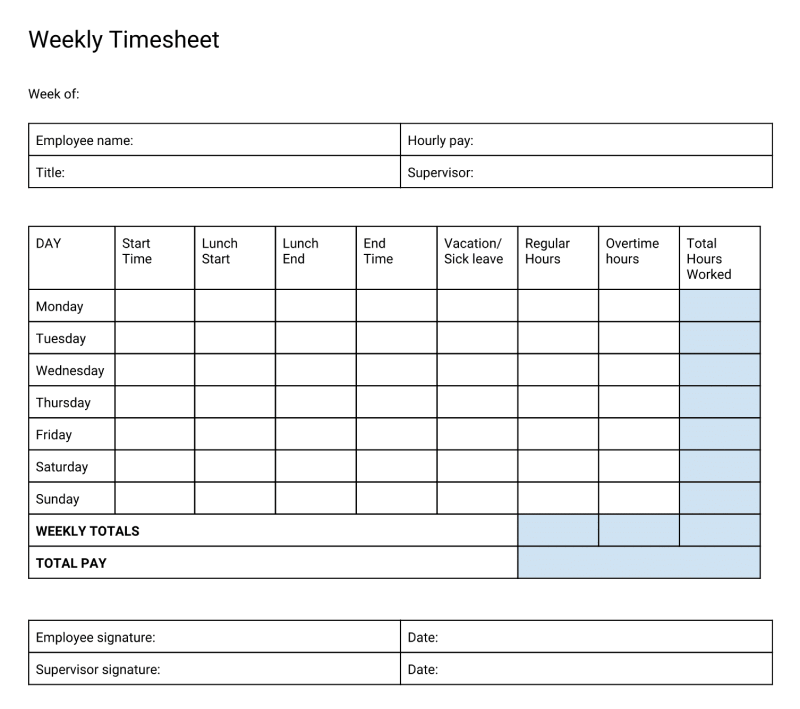

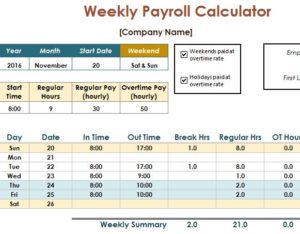

745 11 1210 3 4 430 and it will add up the time worked into a meaningful hourminute format. New zealands best paye calculator. Number of qualifying children under age 17 number of allowances state w4 pre tax deductions 401k ira etc check date mmdd. This will help determine how much an employee costs their employer per hour.

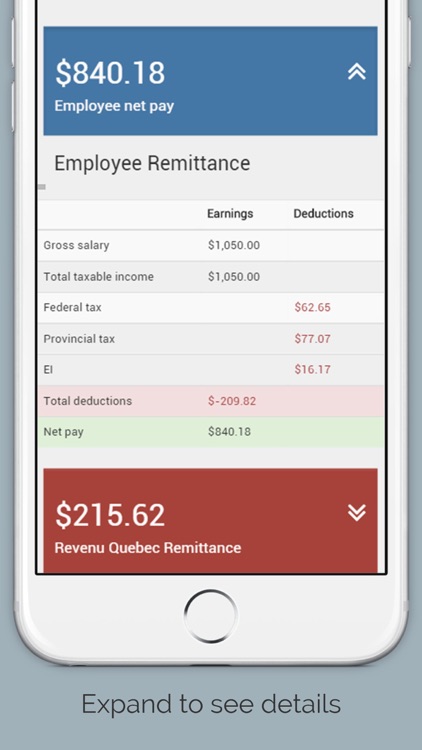

Calculate your combined federal and provincial tax bill in each province and territory. Small business low priced payroll service. Pay raise calculator to calculate the amount of raise after a percentage increase with your current salary. Kiwisaver student loan secondary tax tax code acc paye.

How to calculate semi monthly pay based on bi weekly salary. 635 815 2615 for a total. Calculate your take home pay from hourly wage or salary. Time sheet calculator calculate hours allows you to enter times worked like.

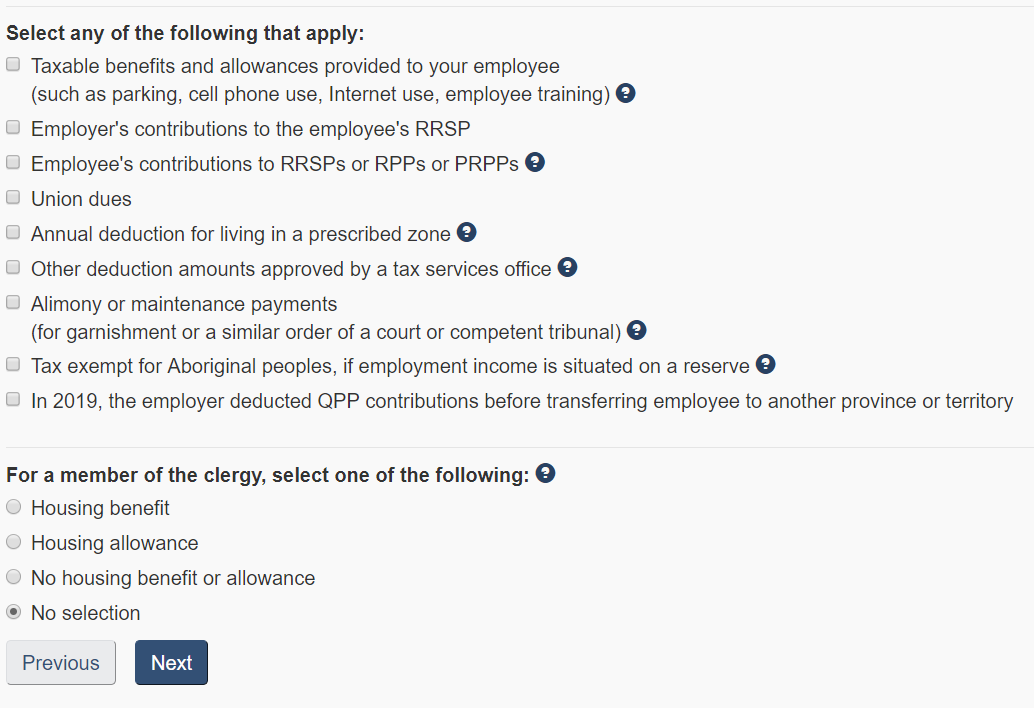

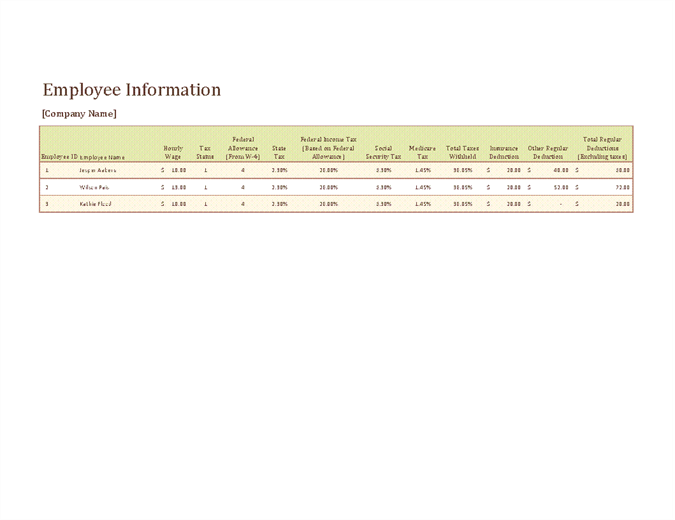

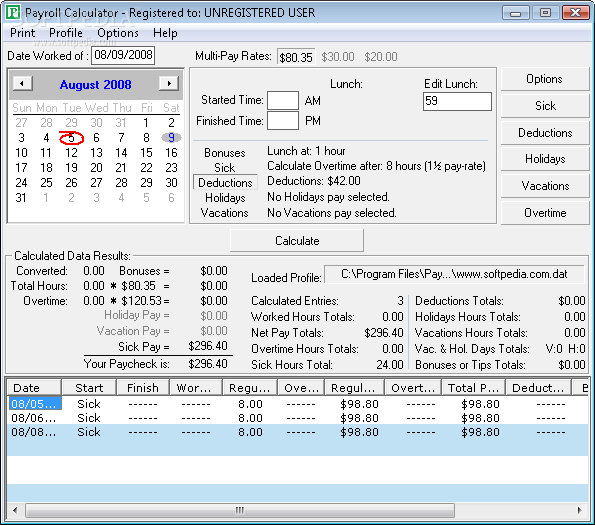

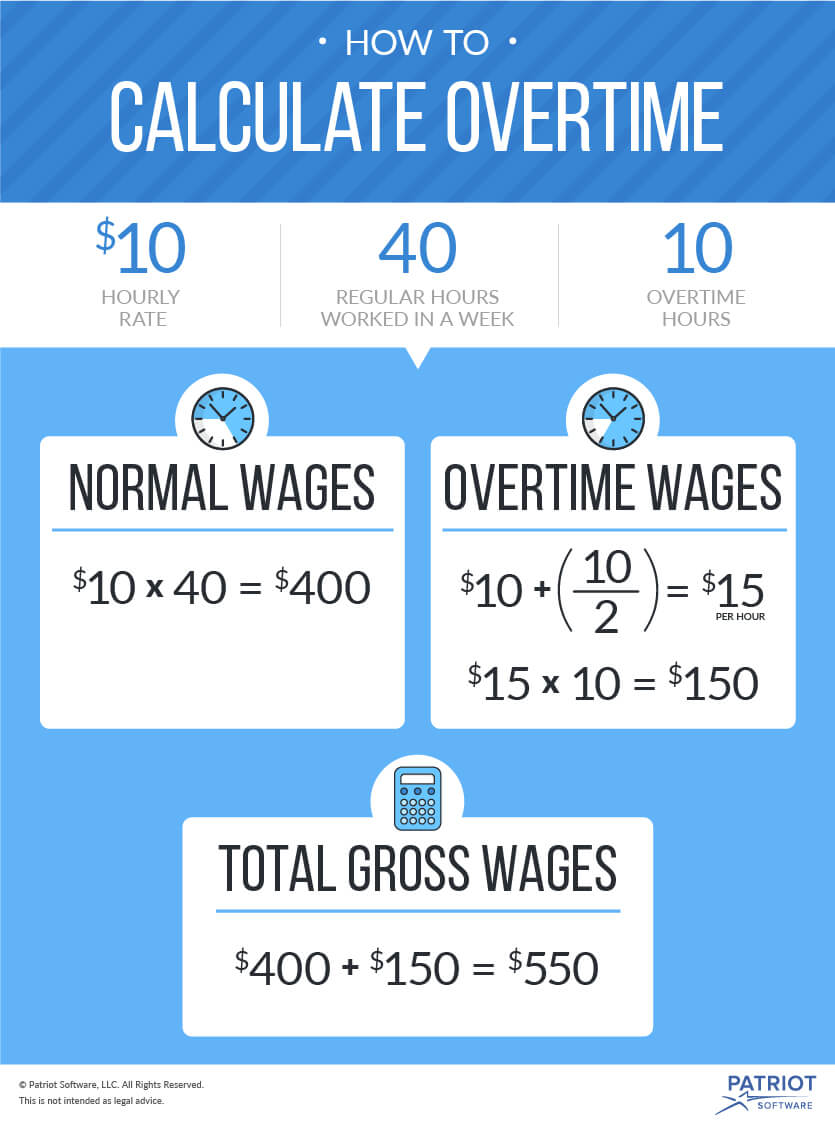

Not all employee types are eligible for all benefits uncheck those that would not apply. Overtime pay rate calculator payroll check compensation wage calculate overtime hourly pay rates given normal or standard pay rate. See the tips below for more information. Free online timecard calculator with breaks and overtime pay rate enter working hours for each day optionally add breaks and working hours will be calculated automatically.

Calculate the tax savings your rrsp contribution generates. Calculates time and a half double triple and quadruple overtime pay rates. Start time end time. Pay raise calculator percent is calculated based on your current salary or hourly rate the working hours per week and the pay raise percentage.

Starting as low as 5month. You can then sum hours like. You can use a period. If you want to calculate total gross pay enter hourly pay rate and choose overtime rate in format 15 for 150 overtime rate.

:max_bytes(150000):strip_icc()/what-is-gross-pay-and-how-is-it-calculated-398696-v1-5bbd1ae146e0fb0026778399.png)